An Ad Valorem Tax Causes the Supply Curve to:

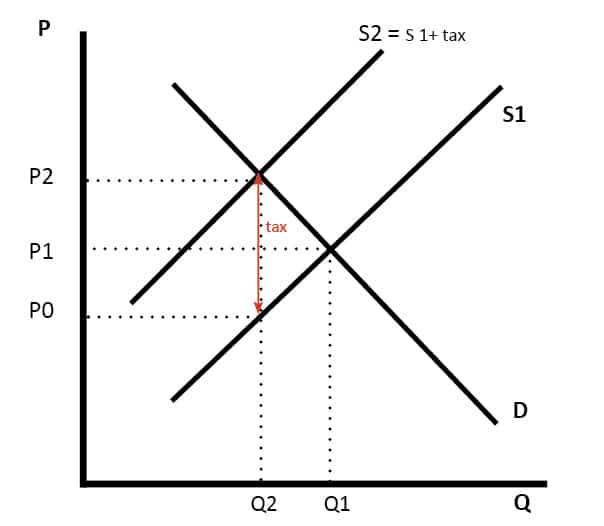

Diagram of ad valorem tax. Regardless of the non-parrallel shift the burden of tax on the consumer and producer is calculated in exactly the same way as a specific tax.

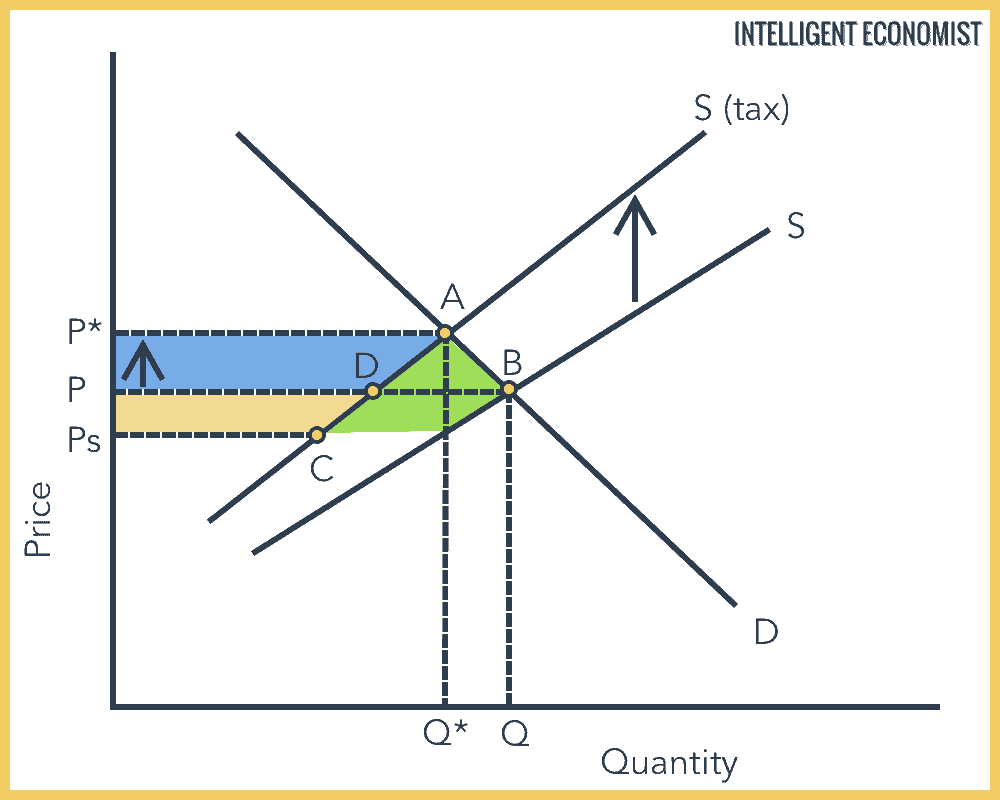

Indirect Tax Intelligent Economist

An ad valorem tax causes supply curve to.

. A tax shifts the supply curve to the left. Suppose the supply of good X is given by QS x 10 2P x. This is because ad valorem tax is always the same percentage of the price therefore higher prices cause a steaper curve.

Shift to the left. An ad valorem tax causes the supply curve to. AAn ad valorem property tax holiday made available to a manufacturing plant that is relocatingbHotel occupancy tax and a rental car surchargecA back-to-school sales tax holiday.

What are the pros and cons of the following state and local tax provisions. An ad valorem tax causes the supply curve to. An ad valorem tax is levied as a percentage of the goods.

It is a value based tax. An ad valorem tax is a value-based tax. It is sometimes called a sales tax.

An ad valorem tax is a percentage tax imposed on a commodity at the time of sales. For example if we take VAT. Shift to the right.

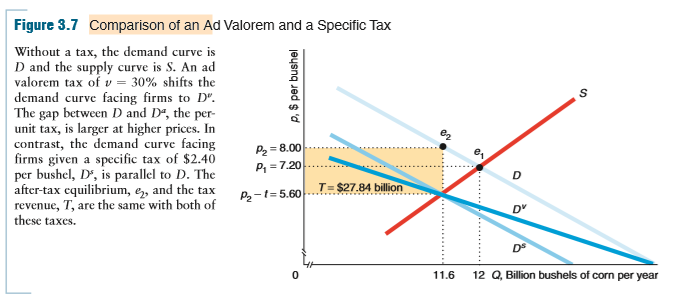

Ad Valorem causes a non-parallel shift of the supply curve. It is imposed in percentage terms and therefore higher the value of the goods higher is the ad valorem taxThe progressivity of a View the full answer. An ad valorem tax The imposition of an ad valorem tax will shift up the supply curve by a certain percentage meaning that the new supply curve will not be parallel to the original.

Shift to the right. Technological advances will cause the supply curve to. The quantity of tax is dependent upon the value of the good being bought.

A specific unit tax will shift up the supply curve by the full amount of the tax so that the new curve is parallel to the original one as shown. Since the effect of this tax is on. Asked Aug 27.

PX 50 - 5QX and PX 32 QX. For this will make our task of explaining the effects of the tax easier. How many units of good X are.

Let us suppose that the demand curve for a good is DD in Fig. Due to the fact that the amount of taxes paid by each individual varies depending on the type of tax one is paying this is the case. This means at lower prices the tax amount is less and at higher price there will be more tax.

We shall assume here that the tax is collected from the buyers rather than from the sellers. Shift to the right. In the supply and demand curves ad valorem taxes result in pivots.

Mar 24 2022 0710 AM. An example of an ad valorem tax is VAT which is 20 in the UK. Answer The ad valorem tax is an indirect tax imposed on the goods and based on the value or price of the good or item.

Shift to the left. The ad valorem tax causes a pivoted inward shift in supply and not a direct inward shift as shown below. Become steeper Consider a market characterized by the following demand and supply conditions.

Shift to the left. It is imposed as a fixed percentage of the price of a commodity. In the supply and demand curves unit taxes cause shifts.

The amount of tax depends on the price. An ad valorem tax causes the supply curve to. An increase in the amount of the tax results in an increase in the supply curve which results in an increase in the amount of.

Government Intervention When The Economy Needs Help Why Do Governments Impose Excise Taxes What Is The Difference Between A Specific And Ad Valorem Ppt Download

The Effect Of A Tax On Supply Part 2 Youtube

Government Intervention When The Economy Needs Help Why Do Governments Impose Excise Taxes What Is The Difference Between A Specific And Ad Valorem Ppt Download

Government Intervention When The Economy Needs Help Why Do Governments Impose Excise Taxes What Is The Difference Between A Specific And Ad Valorem Ppt Download

Direct Indirect Taxes As A Levels Ib Ial The Tutor Academy

Direct Indirect Taxes As A Levels Ib Ial The Tutor Academy

Government Intervention When The Economy Needs Help Why Do Governments Impose Excise Taxes What Is The Difference Between A Specific And Ad Valorem Ppt Download

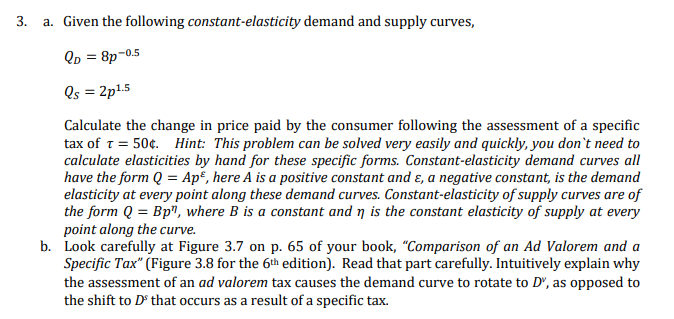

P Per Bushel Figure 3 7 Comparison Of An Ad Chegg Com

P Per Bushel Figure 3 7 Comparison Of An Ad Chegg Com

Carbon Tax Pros And Cons Economics Help

What Is The Impact Of The Gst On A Demand And Supply Curve Quora

What Are The Causes Of The Decrease In The Supply Or Leftward Shift Of The Supply Curve Quora

Comments

Post a Comment